Every technological revolution follows the same pattern. New tech destroys old jobs, creates anxiety about human relevance, then a greater portion of society pivots toward what machines can't replicate: human drama, competition, and storytelling. You don’t need me to tell you, but we're living through that pivot right now.

Look at Olympic participation over the past century. The first modern version of the games, the 1896 Athens Olympics, featured 241 athletes. By Tokyo 2021, that number hit 11,656. Each wave of new technology over the last ~125 years corresponded with surges in athletic participation. The industrial revolution gave us modern sports leagues. The computer age brought us ESPN and 24/7 sports coverage. Now AI is about to make human physical excellence feel more precious than ever.

I believe we're on the verge of the greatest sports league expansion in history. There will be a surge of capital flowing into these leagues, so I wanted to provide some perspective of how I analyze sports leagues.

The Evolution of Sports Business

The 20th century belonged to mass-origin sports. Soccer, basketball, and American football captured billions of fans and generated the largest sports business empires in history. These sports succeeded because they were accessible - anyone could play with minimal equipment, creating enormous participation bases that translated into massive audiences.

But elite-origin sports also found ways to thrive. Tennis evolved from aristocratic lawn parties into global Grand Slams. Golf transformed from Scottish nobility pastime into a worldwide professional tour. These sports proved that elite foundations - wealthy patronage, established governance, premium positioning - could scale beyond country clubs when properly developed.

Today's investment landscape is different. Mass-origin sports like soccer and basketball have monopolistic powers. The NFL, NBA, Premier League, and FIFA have such entrenched positions that new competitors can't meaningfully challenge them directly. These leagues benefit from decades of cultural embedding, infrastructure development, and network effects that make them essentially unassailable at the top.

But monopolistic dominance at the peak doesn't eliminate opportunity. Below, I walk through three league archetypes that will deliver large multiples for sharp investors over the next several years.

Three Paths to Outsized Returns

Path 1: Elite-Origin Sports with “Niche” Audiences

Some sports with elite foundations remain dramatically undervalued relative to their potential. These sports benefit from wealthy patron bases, established governance structures, and premium brand appeal, but haven't yet captured mass audiences.

Formula One shows the ultimate elite success. Drive to Survive generated over $290 million in global streaming revenue for Netflix from 2020-2024, while F1's average viewer age dropped from 44 to 32. The sport leveraged its elite heritage to capture mainstream attention, with US audience figures jumping 71% in three years.

SailGP is a promising upstart. Larry Ellison took sailing and created "Formula One of the seas." Despite sailing's tiny participation base, the league raised $200+ million by targeting what sponsors call "a relatively high-net-worth audience in the luxury space." The league is nearing profitability, selling team franchises for ~$50 million each and attracting blue-chip sponsors like Rolex. Early results are promising, with an estimated 79% of Italian SailGP followers being new to the sport.

Major League Lacrosse shows what can go wrong. Lacrosse has deep elite roots in prep schools and prestigious colleges, with wealthy participant demographics. Yet MLL struggled for years with poor attendance and limited TV deals before being acquired by the Premier Lacrosse League in 2020. The sport had the right audience, MLL just failed to package it properly. PLL's subsequent success with the same sport proves execution matters even with elite foundations.

The key insight: you don't need billions of fans if you have the right fans. Elite-origin sports offer something mass sports can't: authentic exclusivity that luxury brands value. But that exclusivity must be properly marketed and presented.

Look for: Sports with wealthy participant bases, established international competition, and premium venue potential. Avoid: Assuming elite demographics automatically translate to success without proper league structure and marketing.

Path 2: Premiumization of Mass-Origin Sports

The second path takes democratically-rooted sports and gives them elite packaging. This strategy acknowledges that even the most accessible sports need premium positioning to break through modern attention scarcity.

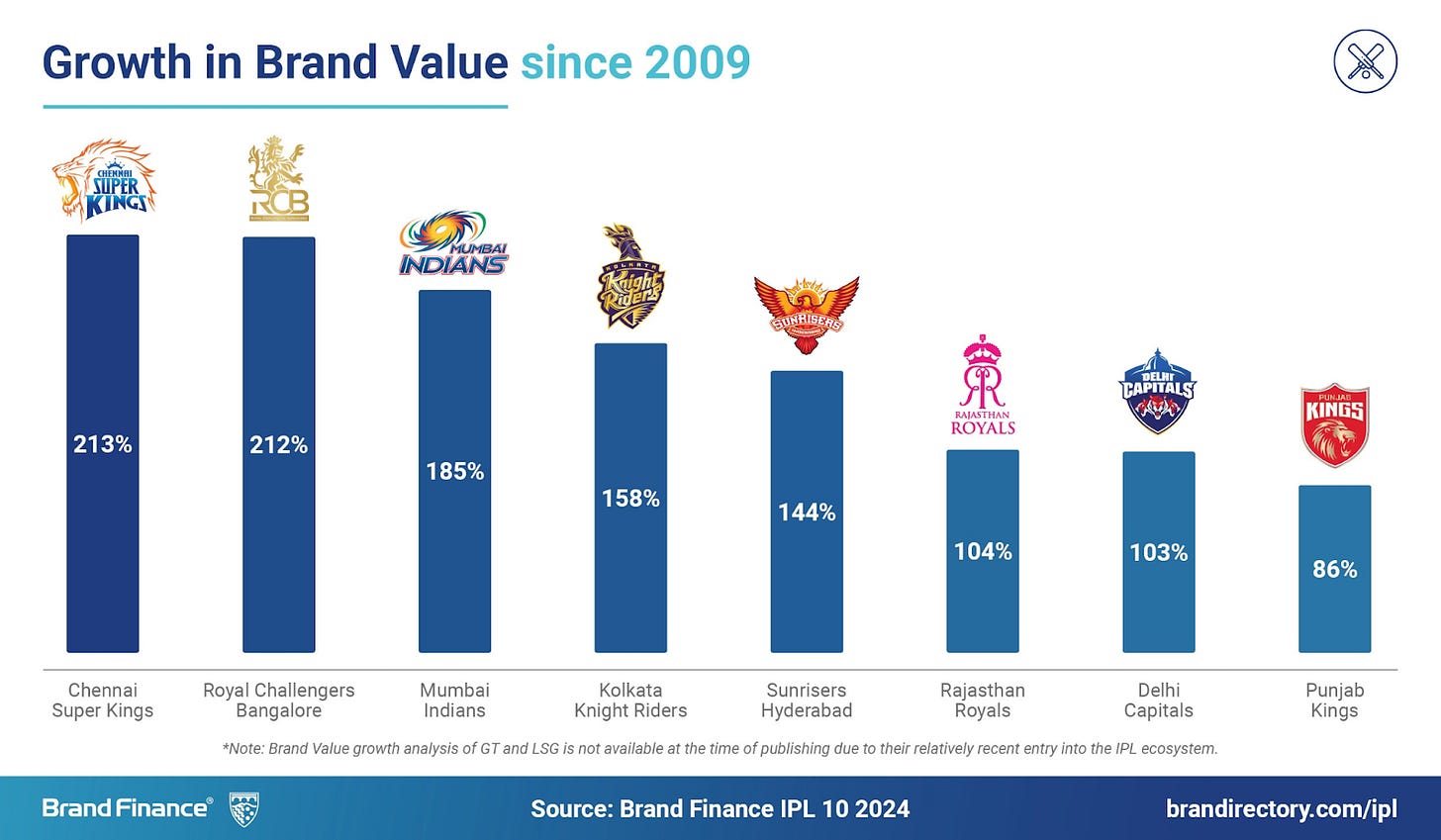

The Indian Premier League perfected this approach at scale. Cricket had elite colonial origins but mass appeal in former British territories. The IPL combined Bollywood glamour with business titan ownership, transforming cricket viewing in India. Result: the league's brand value grew from $2 billion in 2009 to $12 billion in 2024, with media rights generating $16.8 million per match - second, behind the NFL, highest across every major sports league.

Track and field may be next up. Our ATHLOS successfully positioned itself as premium entertainment, attracting major sponsors, world-class musical talent - making track feel exclusive rather than everyman and selling out Icahn stadium. Meanwhile, Grand Slam Track, despite featuring Olympic champions and unprecedented prize money, struggled to fill stadiums even in Jamaica where sprinting is a national obsession because the democratized product did not properly “premiumize” itself.

Look for: Mass-participation sports lacking premium professional structures, opportunities to add entertainment value beyond pure competition, and sports that can benefit from celebrity involvement or cultural positioning. Avoid: Leagues with overly complex rules that confuse casual viewers, or activities that feel inherently recreational rather than aspirational.

Path 3: Making Mass Sports Accessible to ALL Masses

The third path recognizes that even "mass" sports historically excluded significant populations. The fastest venture-like returns in established sport categories come from serving previously underserved audiences.

Women's sports represent the clearest success story. The WNBA delivered record-breaking growth in 2024: 54 million unique viewers (most-watched season in 24 years), 170% increase in ESPN viewership to 1.19 million average, and attendance up 48% to 9,807 fans per game. League Pass subscriptions grew 366%. Revenue estimates suggest the league approached $180-200 million, with franchise expansion fees hitting records at $250 million.

The XFL illustrates the wrong approach. Multiple XFL iterations failed because they targeted the exact same demographic as the NFL (American men) with a lower-quality product. They weren't expanding to "all masses" - they were trying to compete directly with the monopoly for the same audience. The lesson: true market expansion requires serving genuinely underserved populations, not just offering inferior versions of existing products.

Look for: Demographic gaps in established sports, geographic regions underserved by major leagues, and accessibility barriers that technology or new business models can solve. Avoid: Targeting the same demographics as existing monopolies with supposedly "better" or "different" versions.

The Investment Framework

When evaluating opportunities across these three paths, I focus on the below criteria:

For Elite-Origin Small Markets:

Wealthy participant and fan demographics

Established governance and international structure

Premium venue and broadcast potential

Authentic luxury positioning (not manufactured exclusivity)

For Premiumization Plays:

Large participation base with underdeveloped professional structure

Entertainment value beyond pure athletic competition

Opportunity for celebrity involvement or cultural narrative

Clear differentiation from existing mass-market versions

For Underserved Mass Markets:

Significant excluded population in established sport categories

Existing infrastructure that can be repurposed or expanded

Growing cultural momentum and demographic tailwinds

Alignment with broader social or economic trends

The Coming Wave

Technology displacement will create more potential athletes than ever before. Meanwhile, global wealth concentration means premium audiences are both larger and more valuable than before. Streaming platforms need differentiated content. Luxury brands seek exclusive sponsorship opportunities. And a new generation of sports fans expects elevated experiences beyond traditional broadcasts.

These macro tailwinds create multiple paths to venture-like returns in sports leagues. Not every opportunity requires competing with the giants - in fact, the best opportunities often complement them. Elite-origin sports can leverage wealthy patron bases and authentic exclusivity. Mass-origin sports can be premiumized for modern audiences. And underserved demographics represent massive whitespace in established categories.

The key is matching the right strategy to the right opportunity. Elite sports need scaling without losing prestige. Mass sports need elevation without losing accessibility. Underserved markets need investment without losing authenticity.

As someone who spent years watching from the bench, I learned that the best opportunities often come from seeing what others miss. Looking ahead, the question isn't whether new leagues will emerge - it's which investors will recognize the patterns that separate sustainable growth from expensive failures.

We're entering an era where sports league creation will accelerate dramatically. The pattern is clear: while established leagues dominate their peaks, multiple paths to outsized returns run through the territories they can't or won't occupy.

This is Former Benchwarmer, where I break down the business side of sports from an investor's perspective. Views expressed are my own and do not represent those of 776 or its affiliates.